Home Equity Vs Refinance

Homeowners should understand both options and make.

Home equity vs refinance. If you already have a mortgage a home equity loan will be a second payment to make. If youre interested in borrowing against your homes available equity you have choices. Gina pogol the mortgage reports contributor. Generally need to be paid back sooner.

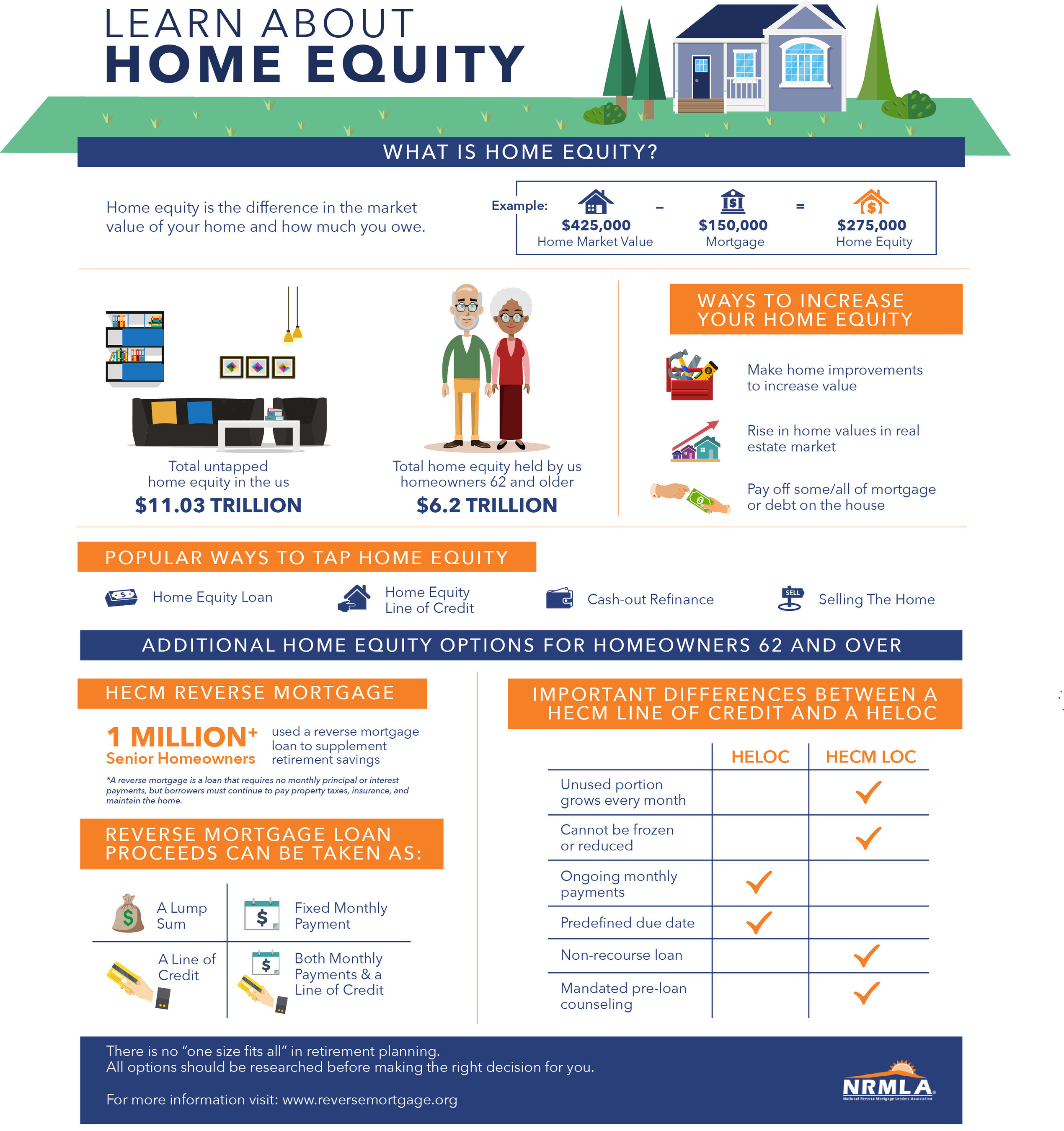

Home equity loan vs. The pros and cons of home equity loans including a home equity line of credit or heloc home equity loan and cash out refinance can be confusing to some borrowers. Here are some of the key differences between a cash out refinance and a home equity line of. March 7 2019 5 min read.

Can offer you a lump sum based on your home equity. Circumstances should dictate the most appropriate option. The lender can eventually seize the home if you dont keep up. Mortgages and home equity loans are both ways to borrow that involve you pledging your home as collateral or backing for the debt.

The better deal might surprise you. Learning about the compo. The long standing debate concerning the wisdom of using a home equity loan or refinancing a first mortgage continues. A traditional refinance and a home equity loan are similar in that both loan types evaluate your credit score to determine whether youre a high risk.

Cash out refinance vs home equity loan. The wisdom of getting a home equity loan or refinancing a first mortgage to get the cash a homeowner needs has no right or wrong choice. Acts as a second mortgage. A home equity loan.

It also can be a source of ready cash should you need it through refinancing or a home equity loanrefinancing pays off your. May be harder to qualify for. Cash out refinances make no sense except. Replaces your existing mortgage loan.

One option would be to refinance and get cash out. A home equity loan and a cash out refinance are two ways to access the value that has accumulated in your home. Your home is not just a place to live and its not just an investment. Home equity line of credit.

Another option would be to take out a home equity line of credit heloc. Home equity loan. Determining which type of. Can be repaid over 15 or 30 years.