First Time Home Buyer

Whether youre just starting to save or you already have a house in mind we can help you get your keys to your first home.

First time home buyer. Talking to only one lender. 6 first time home buyer mistakes to avoid share buying a home is one of the biggest financial decisions youll make in your life and one of the largest sources of stress for many first time buyers is the financing process. Your first step toward buying a home is to understand your budget. As a first time buyer you have access to state programs tax breaks and federally backed loans if you dont have the usual.

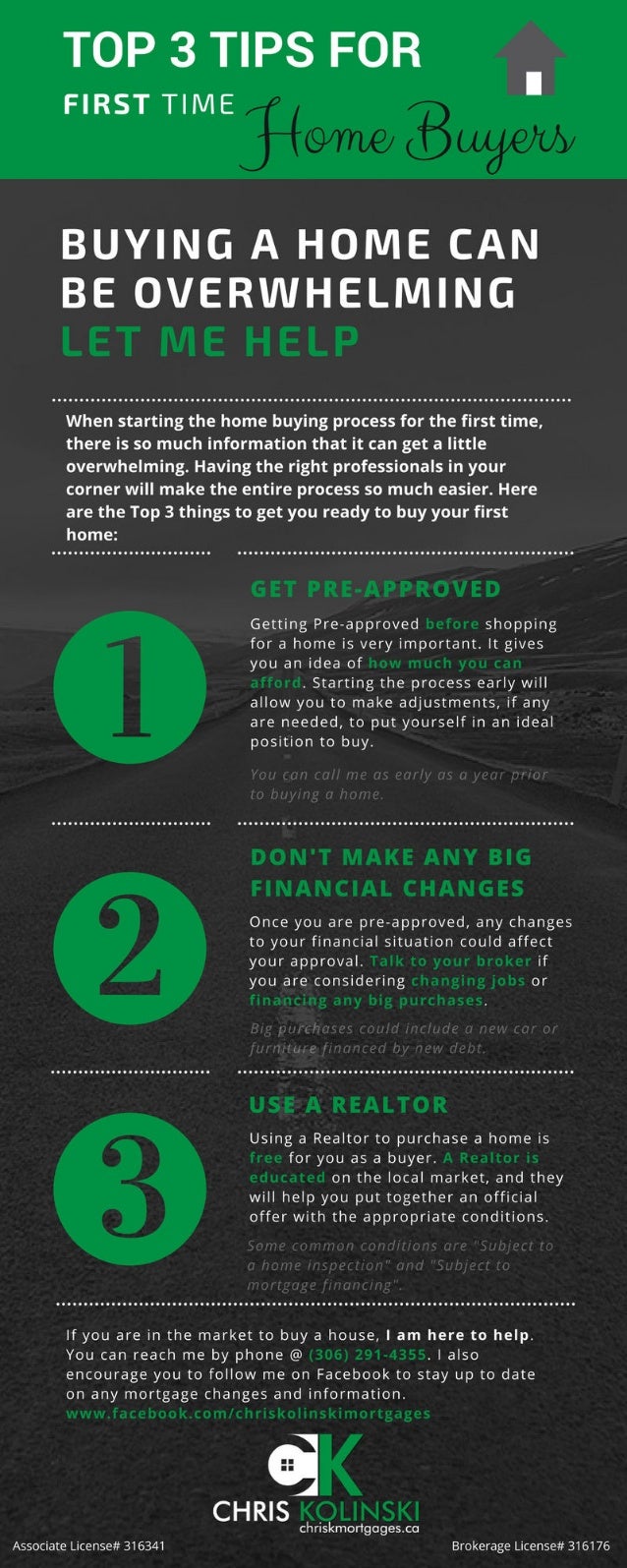

As a first time homebuyer there might be a lot of unknowns. You need to have a good handle on your finances as well as know what you can afford to spend every month on your new home. First time homebuyers can buy a home with a minimum credit score of 580 and as little as 35 percent down or a credit score of 500 to 579 with at least 10 percent down. Whether its the mortgage lingo type of home loans or even down payment requirements the flood of new information can be overwhelming.

Well help you navigate the process more smoothly and save. Here are 14 common first time homebuyer mistakes along with first time homebuyer tips on how to avoid them. Looking for a home before applying for a mortgage. Buying a home is still considered a key aspect of the american dream.

We want to help you learn about few of the things that can slip under. First time home buyers know the basics and improve your fha loan chances. Buying your first home can be exciting and overwhelming all at the same time which is why we have a variety of tools and resources to help you through the experience. Becoming a first time home buyer can be overwhelming.