First Time Home Buyer Requirements

Department of hud 2019 annual report.

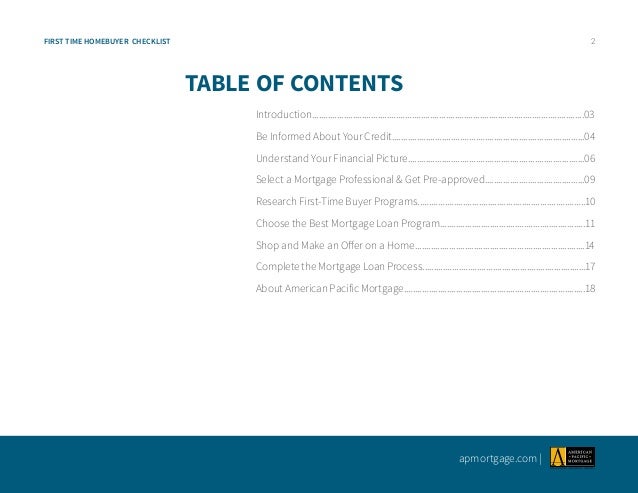

First time home buyer requirements. First time homebuyer requirements buying your first home can seem overwhelming but take a deep breath. First time home buyer infographic. Some loan programs have a zero down payment requirement while many first time homeowner programs require 3 to 10. Purchasing a home for the first time can be a daunting task.

Buying a home has costs associated with it. These are programs that allow previous homeowners to qualify for programs that are targeted to first time homebuyers. Were here to help you. There are many local grants available for first time homebuyers.

How to qualify you may qualify as a first time home buyer if you havent owned your principal residence in the past three years. Contact a real estate agent and check with both your state and county to learn more about what options are available to you. Understanding the process and requirements for your first mortgage can help you plan and uncover any surprises upfront saving yourself from unneeded headaches down the road. One major one is the down payment.

There are programs that are designed to help those who are making a first time home purchase. Local grants to first time home buyers. We want to help you learn about few of the things that can slip under the radar as youre getting ready to buy your new home. Homepath ready buyer buyer has not owned a home in three or more years.

First time home buyer benefits. First time home buyers love fha loans. As a first time homebuyer there might be a lot of unknowns. In this article we are going to go over the different types of mortgage loan options for first time buyers.

First time home buyers know the basics and improve your fha loan chances. Whether its the mortgage lingo type of home loans or even down payment requirements the flood of new information can be overwhelming. Ideal for first time home buyers low 35 down payment requirements favorable credit score requirement of 580 fha loans are the 1 loan type in america with 1141 of all single family residential mortgage originations and 1 market share for first time home buyers at 8284.